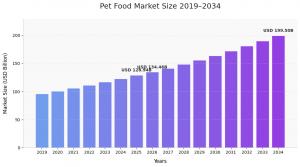

Pet Food Market Size to Reach USD 199.50 Billion by 2034 | CAGR 5.05% (2026–2034)

Pet Food Market Size, Premiumization Trends, and Forecast 2026–2034

North America dominated the pet food market with a market share of 41.71% in 2025”

PUNE, MAHARASHTRA, INDIA, February 11, 2026 /EINPresswire.com/ -- Pet Food Market Overview Analysis— Fortune Business Insights

The global pet food market represents a dynamic and expanding sector driven by fundamental shifts in pet ownership patterns, consumer attitudes toward animal welfare, and evolving nutritional awareness among pet parents worldwide. As companion animals increasingly assume family member status within households, demand for high-quality, nutritious, and specialised food products continues accelerating across diverse market segments and geographic regions.

Market Valuation and Growth Dynamics

The global pet food market size was valued at USD 128.94 billion in 2025. The market is projected to grow from USD 134.46 billion in 2026 to USD 199.50 billion by 2034, exhibiting a CAGR of 5.05% during the forecast period. North America dominated the pet food market with a market share of 41.71% in 2025.

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/pet-food-market-100554

Regional distribution patterns reveal North America's position as the most mature and developed market, with approximately 67% of U.S. households owning pets according to American Pet Products Association data. Europe follows as a substantial market, characterized by sophisticated consumer awareness regarding pet health and nutrition. Asia Pacific emerges as the fastest-growing region, driven by rapid pet adoption increases in China, India, South Korea, and Japan, where expanding middle-class populations and urbanization trends support robust market development.

Product Form Segmentation and Consumer Preferences

Product form analysis reveals dry pet food maintaining dominant market position owing to convenience, extended shelf life, and cost-effectiveness advantages. Dog owners particularly favor dry formulations for their oral health benefits and practical feeding attributes. Research indicates dry food represents the preferred choice for the majority of pet owners, particularly within the substantial dog ownership segment that constitutes the largest portion of the global pet population.

Wet pet food products appeal to consumers seeking enhanced palatability and moisture content for their pets, particularly within the cat ownership segment where hydration considerations drive product selection. The snacks and treats category demonstrates significant growth momentum, propelled by manufacturers' active development of multipurpose, health-focused products offering functional benefits beyond basic nutrition. This segment benefits from consumers' willingness to purchase supplementary products that strengthen human-animal bonds through feeding interactions and reward behaviors.

Price Range Dynamics and Premiumization Trends

Price segmentation analysis reveals medium-priced products capturing the largest market share by appealing to quality-conscious yet price-sensitive consumers seeking balanced value propositions. These mainstream offerings provide accessibility to broad consumer demographics while delivering adequate nutritional standards and brand reliability. The premium segment exhibits the fastest growth trajectory as pet humanization trends drive consumers toward higher-quality formulations featuring specialized ingredients, novel protein sources, and functional health benefits.

Premium product adoption reflects fundamental shifts in consumer perception, where pets are viewed as family members deserving equivalent care standards. This cultural evolution particularly resonates with millennial pet owners, who demonstrate heightened health consciousness and willingness to invest in superior nutrition. The premium segment encompasses organic formulations, grain-free options, limited ingredient diets, and products addressing specific health conditions including obesity management, skin and coat optimization, and digestive wellness.

Distribution Channel Evolution and Digital Transformation

Distribution channel analysis highlights supermarkets and hypermarkets maintaining dominant market share through broad product assortment, convenient accessibility, and competitive pricing strategies. These traditional retail formats provide consumers with comprehensive brand selection and immediate product availability, supporting mainstream purchasing patterns. Specialty pet stores contribute significantly through expert consultation services, premium product curation, and personalized customer engagement that appeals to discerning pet owners seeking specialized solutions.

The online distribution channel demonstrates accelerating growth momentum driven by millennial consumer preferences, subscription service models, and doorstep delivery convenience. E-commerce platforms offer competitive pricing, extensive product reviews, and automated replenishment options that resonate with time-constrained urban consumers. Major manufacturers increasingly collaborate with digital retail giants, recognizing online channels as critical growth drivers. The subscription model particularly gains traction for routine purchases, offering cost savings and purchase automation that enhances customer retention.

Source Material Considerations and Sustainability Trends

Source segmentation reveals animal-based ingredients maintaining market dominance through established nutritional profiles and consumer familiarity. Fish meal, poultry meal, and animal meal provide protein-rich formulations supporting traditional pet food manufacturing. These animal-derived ingredients benefit from extensive availability and proven palatability across dog and cat populations.

Plant-based pet food represents an emerging growth segment driven by vegetarianism trends, environmental sustainability concerns, and evolving consumer values. As pet owners increasingly adopt plant-forward diets themselves, many extend these preferences to their companion animals. This segment benefits from innovation in plant protein sources, fortification technologies, and formulation science that addresses nutritional completeness concerns traditionally associated with plant-based alternatives.

Competitive Landscape and Strategic Positioning

Market concentration analysis reveals consolidation among leading multinational corporations, with the top five players commanding over 60% of global market share. Mars Incorporated leads the competitive landscape through extensive brand portfolio management, strategic acquisitions including Natura and Eukanuba, and sophisticated distribution partnerships with e-commerce platforms. Nestlé S.A., The J.M. Smucker Company, Colgate-Palmolive Company, and General Mills, Inc. complete the dominant player group, each maintaining competitive positions through innovation investments, production capacity expansion, and brand differentiation strategies.

Recent strategic developments demonstrate industry dynamism, with manufacturers expanding production capabilities to meet anticipated demand growth. Pet Factory's USD 23 million investment in a state-of-the-art European production facility exemplifies capacity expansion trends addressing market opportunities. Product innovation remains paramount, evidenced by launches including personalized nutrition formulations, customized dietary solutions addressing specific health conditions, and novel protein sources catering to specialized consumer preferences.

Request for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/pet-food-market-100554

Market Drivers and Future Outlook

Multiple converging factors propel continued market expansion. Global pet ownership increases create fundamental demand growth, with developing economies experiencing particularly rapid adoption rates as middle-class expansion enables pet ownership accessibility. Pet humanization trends drive premiumization, functional nutrition adoption, and preventive healthcare approaches that elevate overall market values beyond basic commodity pricing.

Read More Research Reports:

Pet Care Market Size, Share & Industry Analysis

Omega-3 fatty acids Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.