Fast-Food Containers Market Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

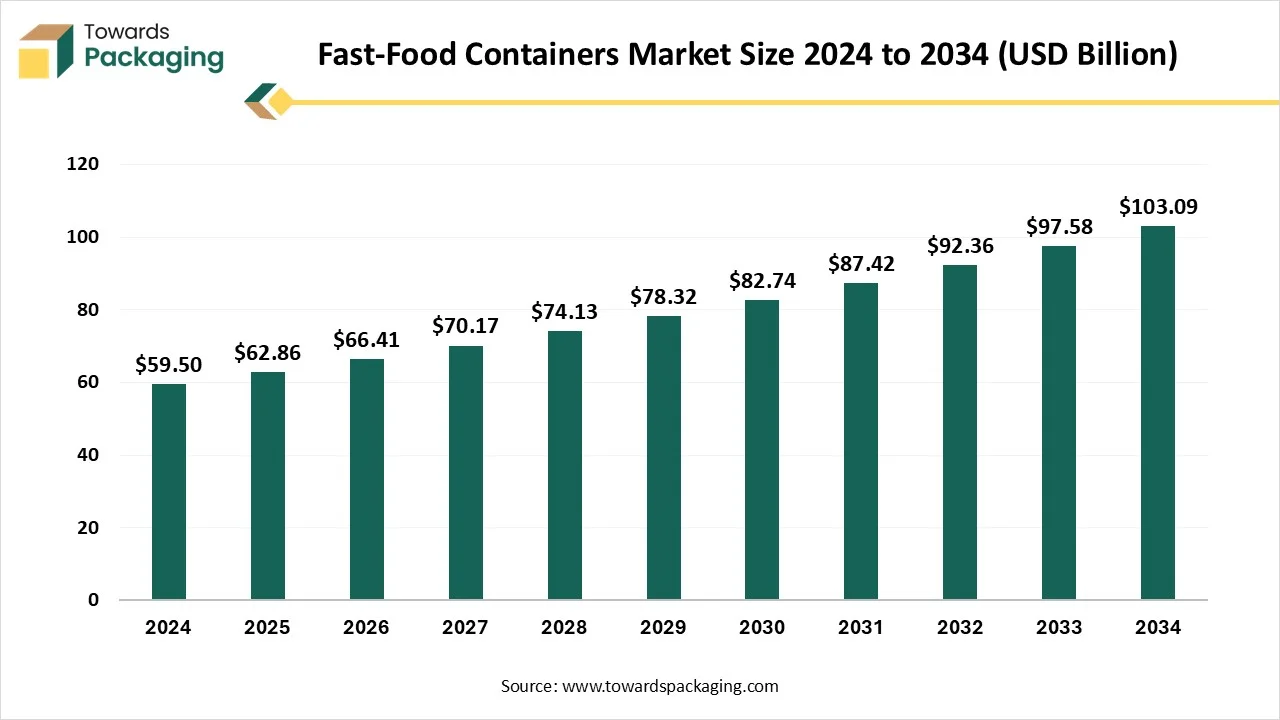

The fast-food container market size reached USD 59.5 billion in 2024, grew to USD 62.86 billion in 2025, and is projected to hit around USD 103.09 billion by 2034, expanding at a CAGR of 5.65% during the forecast period from 2025 to 2034.

Ottawa, Nov. 03, 2025 (GLOBE NEWSWIRE) -- The global fast-food containers market stood at USD 62.86 billion in 2025 and is projected to reach USD 103.09 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research. This market is growing due to the booming popularity of food delivery and takeout services, coupled with a strong industry-wide shift toward sustainable, innovative packaging solutions.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Major Key Insights

- By region, the Asia Pacific dominated the global market by holding the highest market share in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By material, the paper & paperboard segment contributed to the biggest market share in 2024.

- By material, the plastic segment will be expanding at a significant CAGR between 2025 and 2034.

- By product type, the clamshells & boxes segment contributed the biggest market share in 2024.

- By product type, the cups & lids segment is expected to expand at a significant CAGR between 2025 and 2034.

- By end-user, the quick-service restaurants (QSRs) segment contributed the biggest market share in 2024.

- By end-user, the food delivery & takeaway services segment is expanding at a significant CAGR between 2025 and 2034.

- By distribution channel, the direct sales (to QSRs and Chains) segment dominated the market with a share of in 2024.

- By distribution channel, the online retail/marketplace segment will be expanding at a significant CAGR between 2025 and 2034.

Market Overview

The fast-food container market is expanding steadily due to expanding urban lifestyles, the booming food delivery business, and the growing demand for takeout. To satisfy consumer demands and environmental regulations, businesses are concentrating on creating packaging that is small, strong, and environmentally friendly. Product innovation and manufacturing trends are also changing as a result because of the use of recyclable and biodegradable materials.

- In January 2025, Genpak LLC launched its Grab-A-Bowl series from durable polypropylene, designed to support both dining and delivery needs.

Market Outlook

- Industry Growth Overview: The fast-food container market is growing rapidly due to rising food delivery demand, expanding QSR chains, and innovations in lightweight, durable packaging materials.

- Sustainability Trends: To use less plastic, manufacturers are implementing recyclable, compostable, and biodegradable materials. Government restrictions on single-use plastics and eco-friendly designs are driving the market toward more environmentally friendly options.

-

Startup Ecosystem: Startups drive change with compostable, edible, and smart packaging solutions. Their focus on innovation and sustainability is reshaping the future of food packaging.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5822

Segmental Insights:

By Material

The paper & paperboard segment dominated the fast-food containers market in 2024, driven by consumers growing desire for packaging options that are biodegradable and sustainable. The market leadership of food chains has been strengthened by their adoption of eco-friendly paper-based packaging in response to growing environmental concerns and government restrictions on single-use plastics.

The plastic segment is expected to grow at the fastest rate in the market during the forecast period due to its durability, lightweight nature, and cost efficiency. The growing use of recyclable and bio-based plastics in container production is also fueling its demand among fast food outlets seeking a balance between sustainability and convenience.

By Product Type

The Clamshells & boxes segment held the largest share in the market in 2024 because they are adaptable and can preserve the temperature and freshness of food. Burger sandwich and combo meal chains frequently use these containers because they provide excellent presentation and protection, making them the go-to option for fast food packaging.

The cups & lids segment is expected to grow at the fastest rate in the market during the forecast period as beverage sales and takeaway coffee culture continue to expand globally. Increasing demand for spill-proof, insulated, and compostable cup solutions is further supporting the rapid growth of this segment.

By End User

Quick-service restaurants segment held the largest share of the market in 2024 due to the growth of well-known brands like McDonald's, KFC, and Subway, as well as the increase in fast-food consumption worldwide. This market's leadership has been sustained by its steady demand for branded long-lasting and adaptable packaging options.

The food delivery and takeaway services segment is expected to grow at the fastest rate in the market during the forecast period, fueled by the rapid rise of online food delivery platforms. Convenience, hygiene, and tamper-proof packaging have become key priorities, pushing innovation and demand in this segment.

By Distribution Channel

The direct sales segment held the largest share of the market in 2024 because major fast-food chains and restaurant groups prefer to buy directly from packaging manufacturers in order to guarantee timely delivery, cost savings, and quality control. Stronger supply chain coordination and improved customization are offered by this channel. Additionally, production consistency and pricing stability are improved by long-term agreements between suppliers and food giants.

The online retail/marketplace segment is expected to grow at the fastest rate in the market during the forecast period, encouraged by the growth of e-commerce sites that provide small and medium-sized food vendors with a variety of adaptable and environmentally friendly packaging options. Growing digitalization has improved the ease of design selection and bulk purchasing. Additionally, small restaurant chains are choosing online procurement due to cost-effective logistics and door-to-door delivery.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Regional Analysis

Asia Pacific held the largest share of the market in 2024, fueled by the fast-growing fast-food culture, the rapid urbanization, and the robust presence of domestic packaging manufacturers providing reasonably priced solutions. Busy lifestyles and rising disposable incomes are driving up the consumption of meals consumed on the go. Furthermore, regional market dominance is being fueled by growing awareness of eco-friendly packaging alternatives in nations like China and India

North America expects significant growth in the fast-food containers market during the forecast period. Driven by growing consumer demand for recyclable and environmentally friendly food containers, stricter packaging laws, and increased sustainability awareness. Innovations in biodegradable plastics and the move toward plant-based materials are speeding up market growth. The adoption of next-generation sustainable packaging solutions is also being aided by partnerships between QSR chains and packaging manufacturers.

More Insights of Towards Packaging:

- Meat Packaging Market Size, Segments Data, Regional Analysis & Competitive Landscape

- Tea Packaging Market Size, Segmentation, and Growth Forecast (2025-2034)

- Snacks Packaging Market Size, Segments and Competitive Analysis

- Chocolate Bar Packaging Market Size, Segments Data, and Competitive Landscape

- Ice-cream Packaging Market Size, Segments Data, and Competitive Landscape

- Poultry Packaging Market Size, Segments Data, and Regional Analysis (NA, EU, APAC, LA, MEA) with Competitive Insights

- Bakery Packaging Market Size, Segmentation, and Regional Analysis (NA, EU, APAC, LA, MEA)

- Plastic Food Packaging Market Size, Segments, and Regional Analysis

- Hermetic Packaging Market Size, Segmentation, and Competitive Insights (2024-2034)

- Seafood Packaging Market Size, Segments Data and Competitive Analysis (2024-2034)

- Pet Food Packaging Market Size, Share, Segments, and Regional Insights 2025-2034

- Edible Packaging Market Size, Share, Trends, Segments, Regional Insights, and Competitive Landscape 2034

- Frozen Food Packaging Market Size, Share, Segments, Regional Outlook, and Competitive Landscape to 2034

- Mushroom Packaging Market Size, Segments, Regional Data, Competitive Landscape and Value Chain Analysis

- Feed Packaging Market Regional Insights, Segmentation, Materials, End Users and Key Players

- Asia Pacific Food Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

Value Chain Analysis

- Raw Materials Sourcing: The market for fast food containers begins with the procurement of paper, paperboard, plastics, and bioplastics. Growing emphasis on plant-based and recycled materials guarantees sustainability and legal compliance while preserving supply consistency and quality.

- Component Manufacturing: Molding, thermoforming, and coating technologies are used to turn raw materials into finished goods like clamshells, cups, and lids. For large fast food companies, automation and digital printing allow for quicker, more environmentally friendly, and customizable production.

-

Logistics and Distribution: Finished containers are transported via effective logistics networks to distributors, delivery platforms, and eateries. E-commerce platforms make purchasing in bulk easier, and in an effort to reduce carbon emissions, sustainable packaging and transportation methods are bseing used more and more.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the market

- Amcor plc: A global leader in producing flexible and rigid packaging for food, beverage, pharmaceutical, and other industries.

- Berry Global Inc.: A global manufacturer and marketer of plastic packaging products, known for its rigid, flexible, and nonwoven materials.

- Smurfit WestRock: A global leader in sustainable, paper-based packaging that was formed by the merger of Smurfit Kappa and WestRock.

- Huhtamaki Oyj: A global food packaging company from Finland that produces disposable tableware, flexible packaging, and egg cartons.

- WestRock Company: An American provider of paper and packaging solutions, which merged with Smurfit Kappa to become Smurfit WestRock.

- International Paper Company: A leading global producer of renewable fiber-based packaging, pulp, and paper products.

Other Players

- Dart Container Corporation

- Genpak LLC

- Sabert Corporation

- Eco-Products, Inc.

- BioPak

- Detmold Group

- Hinojosa Packaging Group

Market Segmentations

By Material

- Paper & Paperboard

- Plastic

- Foam

- Aluminum

- Biodegradable/Compostable Materials

By Product Type

- Clamshells & Boxes

- Cups & Lids

- Bowls & Trays

- Wraps & Bags

- Others (Cutlery, Plates, Portion Packs)

By End-User

- Quick-Service Restaurants (QSRs)

- Cafés & Coffee Shops

- Food Delivery & Takeaway Services

- Street Vendors & Small Food Outlets

- Others (Catering, Institutional Buyers)

By Distribution Channel

- Direct Sales (to QSRs and Chains)

- Distributors & Wholesalers

- Online Retail/Marketplace

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Recent Developments

- In February 2025, Harvest Group launched a new pulp food container series (CO Series, CRO Series, CT006 square tray, 4-compartment lunch box) made of sugarcane bagasse, biodegradable & compostable, oil & heat resistant.

- In March 2025, Plancon announced the launch of its Fresh n Clear Dip Cup line (10oz, 16 oz,24 oz, 30 oz) made from EcoStar material (minimum 10% recycled PET, 1 resin code) for dips/spreads/hummus.

FAQ

How is the structure of fast-food containers designed to meet global market demands?

Fast food containers are designed for convenience, safety, and sustainability, featuring heat insulation, leak resistance, and stackability. Multi-layer coatings and durable designs help maintain food freshness during transport while supporting recyclability and eco-compliance.

What are the major raw materials used in the global fast food container industry?

Key materials include paperboard, molded fiber, plastics (PET, PP, PE), aluminum, and bioplastics. The shift toward eco-friendly, compostable, and recyclable materials is driven by rising environmental awareness and waste reduction mandates.

What types of fast-food container solutions are most used globally?

Clamshells, boxes, cups, trays, and lids dominate due to versatility and convenience. Meanwhile, biodegradable and smart packaging solutions are rapidly growing with the rise of delivery platforms and sustainability goals.

What are the references?

Packaging Strategies, Smithers Pira, Packaging Gateway, and European Bioplastics Association.

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5822

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Chitosan-Based Aerogel Food Active Packaging Market Competitive Positioning

- PFAS-Free Food Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- Food and Beverage Metal Cans Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Europe Fresh Food Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Food Cans Market Dynamics, Competitive Forces and Strategic Pathways

- Food Packaging Equipment Market Strategic Analysis & Growth Opportunities

- Compostable Tableware Market Strategic Analysis and Growth Opportunities

- Milk Packaging Market 2025 Driven by Eco-Friendly Trends to Reach USD 81.35 Billion by 2034

- Egg Boxes and Trays Market 2025 Supermarkets Dominate Distribution, Biodegradable Composites Rise Fastest

- Connected Food Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Sustainable Minimalistic Tableware Packaging Market Competitive Landscape & Future Outlook

- Thermoformed Food Packaging Trays Market Growth Rate 2034

- Food Packaging Films Market Evolve to Meet Hygiene, Shelf Life, and Regulatory Needs

- Rigid Food Packaging Market Trends, Share, and Growth Analysis 2034

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.